We’re carrying less in our wallets — and it’s not a fad. It’s the inevitable result of a cash-free society taking shape worldwide.

Digital payment systems, contactless cards, and mobile wallets are redefining what we actually need to carry. According to The Next Web (2016), the journey toward “frictionless, invisible payments” began nearly a decade ago. Fast-forward to 2024, and that prediction has materialized:

Over 4.3 billion people — 53% of the world’s population — now use digital wallets. (Finder 2024)

A quick look at Kickstarter still returns 2,000+ wallet projects, nearly all minimalist, designed for the digital-first generation. The message? Thin is the new timeless.

Minimalist Wallets Are Hot. Cash Is Not.

In 2012, cash made up 40% of U.S. payments. By 2024, digital payment usage in stores jumped from 19% in 2019 to 28% in 2024. (McKinsey 2024)

Countries like Sweden, South Korea, and France have aggressively pushed toward cash elimination. France and Spain legally limit cash transactions, while the Bank of Korea continues its long-term plan for a cashless economy.

Globally, contactless payments now make up about 75% of in-person transactions. (CoinLaw 2024)

Cash is no longer king — efficiency is.

Sweden: The Living Experiment

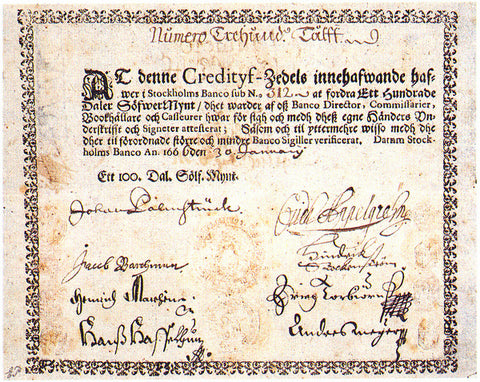

Sweden offers a glimpse into the future. After a wave of armored-car robberies, banks and the private financial sector began pushing for a cashless model. Between 2010 and 2012, 500 branches went cash-free, and 900 ATMs were removed.

By 2016, cash in circulation dropped from SEK 106 billion to under SEK 80 billion, and today Sweden remains the global test case for near-total digital adoption.

Professor Niklas Arvidsson’s The Cashless Society predicted Sweden would be fully cash-free by 2030. That timeline still looks accurate: newer government data shows over 95% of retail transactions are now digital.

Sweden’s transition wasn’t accidental — it’s driven by technology infrastructure (ranked 3rd in computers per capita) and cultural acceptance of innovation.

What People Actually Buy with Mobile Wallets

Lightspeed Research found that mobile wallets are used most often for:

-

Food & drink (40%)

-

Convenience stores (34%)

-

Large retail (31%)

-

Household bills (29%)

-

Telecom services (27%)

Those were early insights — and today, the trend has intensified. Food, retail, and public transport dominate digital transactions globally.

From Cards to Apps — and Beyond

Cards dethroned cash, and now apps are replacing cards. Between 1998 and 2013, U.S. credit-card transactions grew from 213 million to 2.4 billion. That trajectory hasn’t slowed.

Today, services like Apple Pay, Google Wallet, and Swish are mainstream. In fact, Japan’s cashless payment ratio hit 42.8% in 2024, according to the Ministry of Economy.

Even churches in Sweden now accept donations via Swish (Ped Herskoog, 2015). Street vendors of Situation Stockholm use card readers — and sales jumped 30%.

Cards may not disappear soon (Wired, 2016), but their dominance is fading fast.

Consequences of Going Cashless

Not all effects are positive. As Jacob de Geer, founder of iZettle, warns:

“Big Brother can watch exactly what you’re doing if you purchase things only electronically.”

Electronic fraud in Sweden has already exceeded 140,000 cases annually.

The Electronic Frontier Foundation’s Rainey Reitman adds:

“Digital payments create a trove of data we have no control over — once your transaction history exists, it becomes a target.”

Yet, according to the European Central Bank 2024, cash still plays a role, particularly for small, local transactions.

The Minimalist Wallet’s Role

Even as payments go digital, wallets remain relevant — just redefined.

IDs, driver’s licenses, access cards, and emergency cash still require a slim, organized home.

That’s where minimalist wallets come in. The modern Axess wallet embodies Essentialism: carrying only what matters, designed to fit seamlessly in your front pocket.

Made from vegetable-tanned Italian leather, each Axess wallet is engineered for the world we live in — where style meets function, and less truly means more.